Pay in Installments Using Apple Pay: Here’s How It Works

Apple ended its Pay Later service but now offers a new "Buy Now, Pay Later" option. Explore how it works!

Apple Pay makes paying for things quick and secure using your iPhone, iPad, or Apple Watch. One cool feature was Apple Pay Later, which let you split purchases into smaller payments over time. But things have changed!

Apple has discontinued its own Pay Later service and now works with other companies to offer Buy Now, Pay Later (BNPL) options. This article explains how to use Apple Pay Later, manage your payments, and check your balance.

Table of Contents

- Did Apple End Its Pay Later Service?

- What Is "Buy Now, Pay Later" (BNPL)?

- How Apple Pay Later Works

- How to Set Up Buy Now, Pay Later in Apple Pay

- How to Use BNPL with Apple Pay at Checkout

- Managing Your Loans in Apple Wallet

- When Should You Use Apple Pay Monthly Installments?

- Risks and Considerations

- Troubleshoot Common Issues

- Buy Now, Pay Later—But Use It Wisely

Did Apple End Its Pay Later Service?

Yes, Apple ended its own Apple Pay Later service in 2024. It no longer offers its “pay in four” loans directly. Instead, Apple now partners with companies like Affirm and Klarna to provide BNPL options when you use Apple Pay.

If you had an Apple Pay Later loan before, you can still manage it through the Wallet app or contact Apple’s Pay Later Specialist at (866) 732-7753 for help. For more details, check Apple’s official support page: Apple Pay Later Support.

What Is “Buy Now, Pay Later” (BNPL)?

Buy Now, Pay Later (BNPL) is a way to pay for something over time instead of all at once. Imagine you buy a $200 coat but only pay $50 per month for four months. BNPL breaks your purchase into smaller payments. If you pay on time, you usually don’t pay interest. It’s like a mini loan.

With Apple Pay, you can use BNPL for online or in-app purchases—but not in physical stores. Companies like Affirm and Klarna handle these payments, while Apple Pay makes the process smooth and secure.

How Apple Pay Later Works

Apple Pay no longer offers its own BNPL program, but it supports third-party providers that allow you to split payments. Here’s how it works:

- You shop online or in an app and choose Apple Pay at checkout.

- If the purchase qualifies, you’ll see a Pay Later option.

- You pick a provider (like Affirm or Klarna), choose a payment plan, and confirm with Face ID or Touch ID.

- The provider pays the merchant upfront, and you pay the provider back in installments.

- Apple Pay keeps your transactions secure, and you manage payments through the provider’s app or Apple Wallet.

Also Read: What Stores Take Apple Pay? The Ultimate Guide

Available Providers in 2026

Apple partners with companies like:

- Affirm: Offers flexible plans over 3, 6, or 12 months. Interest rates range from 0% to 36%, depending on your credit and plan.

- Klarna: Often provides “Pay in 4” (four equal payments every two weeks) with 0% interest, or longer plans with interest up to 24.99%.

- Afterpay: Offers four equal payments over six weeks with no interest. Late fees may apply for missed payments.

- Synchrony: Eligible Synchrony Mastercard holders can choose Pay Later options and redeem rewards during checkout for fixed monthly payments.

Other providers may be added in the future, so check the Wallet app for available options. Each provider has unique terms, so review them carefully.

How to Set Up Buy Now, Pay Later in Apple Pay

To use BNPL with Apple Pay, you must meet certain criteria:

- Your iPhone must run iOS 18 or later

- You must be 18 or older

- Some providers may require identity verification or a good credit score

Then, set up Apple Pay and add your BNPL provider’s virtual card.

Creating a BNPL Account (Example: Affirm)

- Download the Affirm app or visit their website.

- Enter your mobile number, name, birthday, and last four-digit SSN number for identification.

- Follow the on-screen prompts to sign up and create your Affirm account.

- They will run a credit check. You can get pre-qualified for spending limits, up to $30,000.

- Once you get the Affirm virtual card, add it to your Apple Wallet.

Adding a BNPL Card to Wallet

- Open the Wallet app.

- Tap the + button at the top and select Debit or Credit card to add it.

- Enter the card details manually. Your provider will verify it.

Once added, you’re ready to use BNPL at checkout!

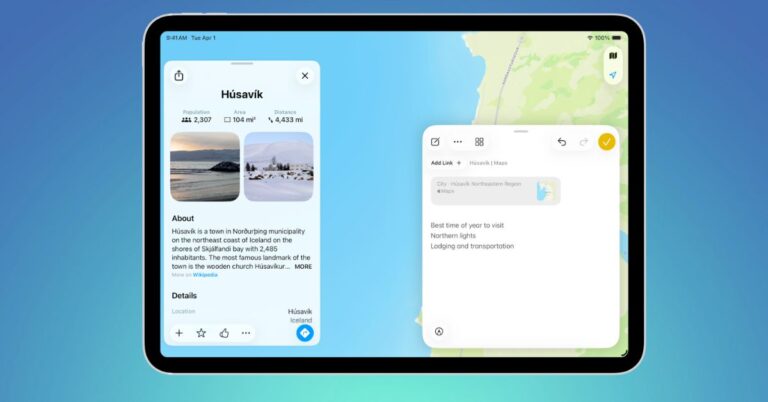

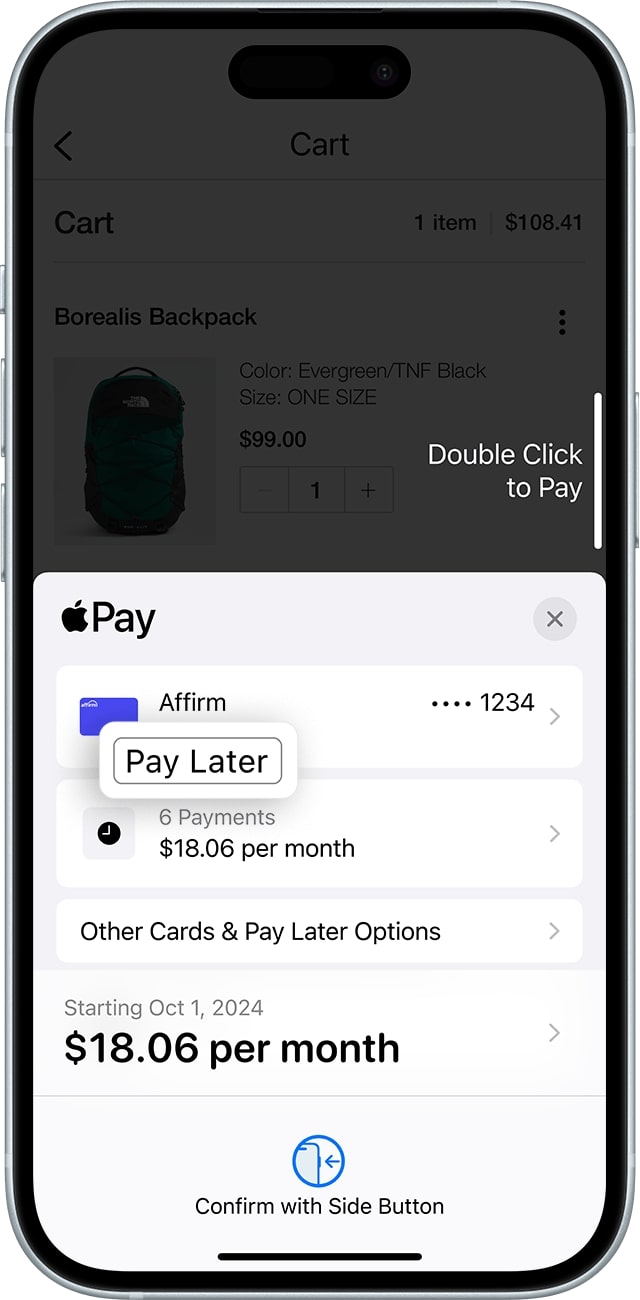

How to Use BNPL with Apple Pay at Checkout

Here’s how to use BNPL when shopping online or in apps:

- Look for the Apple Pay button at checkout on mobile websites or apps.

- Select Apple Pay as your payment method and tap your BNPL card.

- You’ll see Pay Later under your card. To select another card, tap Change Payment Method or Other Cards & Pay Later Options.

- Now, select Pay Later on the Payment Options screen.

- If the purchase qualifies (usually $50-$1,000), you’ll see installment options with interest rates. Select a payment plan (e.g., $25 every two weeks for four payments).

- Check the payment schedule, interest (if any), and total cost. For example, a $300 purchase with Affirm might be $27.08/month for 12 months at 15% APR.

- Tap Agree & Continue to proceed.

- Approve with Face ID, Touch ID, or your passcode.

You’ll see the transaction marked in your Wallet app, clearly showing it as a BNPL purchase.

Managing Your Loans in Apple Wallet

You can track BNPL payments in two places:

In Apple Wallet:

- Open the Wallet app and tap your BNPL card (e.g., Affirm’s virtual card).

- See your payment plan, due dates, and remaining balance.

- Look for Preauthorized Payments to view upcoming charges.

In the Provider’s App:

- Use the Affirm or Klarna app to check your balance, pay early, or adjust plans (if allowed).

- Contact the provider for issues like missed payments or refunds.

Refunds: If you return an item, the merchant processes the refund, which may take up to 10 days. Your provider will adjust the payment schedule accordingly.

When Should You Use Apple Pay Monthly Installments?

BNPL is a smart option for:

- Big purchases: Spread out costs for electronics, furniture, or clothing.

- Budgeting: Avoid large lump-sum payments or using a credit card.

- Interest-free plans: Choose 0% APR plans like Klarna’s “Pay in 4.”

- Convenience: Enjoy fast, secure checkouts via Apple Pay.

However, don’t use BNPL for impulse purchases. It’s best for planned expenses you can afford to pay off on time.

Risks and Considerations

BNPL is convenient, but it comes with risks:

- Overspending: Small payments can lead to buying more than you can afford.

- Interest rates: Some plans, especially long-term ones, may charge up to 36% APR.

- Credit impact: BNPL usage will be factored into FICO scores. Missed payments can hurt.

- Missed payments: May lead to late fees or collections.

- Privacy concerns: Apple Pay keeps your info secure, but providers may collect shopping data. Review their privacy policies.

Alternatives to Consider:

- Apple Card Monthly Installments (for Apple products): 0% APR, 3% cashback

- PayPal Pay in 4: A widely accepted BNPL option with flexible terms

Troubleshoot Common Issues

Here are fixes for common Apple Pay problems:

| Problem | Solution |

| “Pay Later” not showing | Ensure your device runs iOS 18 or later and that the BNPL card is added. |

| Payment declined | Update your info or verify your account with the BNPL provider. |

| Can’t add BNPL card | Make sure the provider’s app supports Apple Pay and is up to date. |

| Refund not processed | Contact the merchant first, then the BNPL provider if needed. |

| Wallet notifications missing | Enable Wallet alerts in Settings > Notifications. |

Still need help? Call Apple BNPL Support at 1-866-732-7753, available 8 AM – 11 PM ET.

Buy Now, Pay Later—But Use It Wisely

Apple Pay’s monthly installment options make shopping more flexible and secure. With providers like Affirm and Klarna, you can split your payments easily and track them within the Wallet app. Setup is simple—but remember to read the terms, avoid overspending, and pay on time to stay financially healthy.

If you have questions, feel free to leave them in the comments!

FAQs

Yes, it might. Starting in Fall 2025, FICO will include BNPL payment history in your credit score. Paying on time could improve your score, while missed payments may negatively affect it. Some providers, like Affirm, may run a soft credit check (which doesn’t affect your score), while others might do a hard inquiry. Always check the provider’s terms before signing up.

Related articles worth reading: