5 Tips to maximize mobile banking and security on iPhone

The banking landscape has dramatically shifted to digital platforms, with mobile banking becoming increasingly prevalent among iPhone users. Much like the rest of the world, mobile banking penetration has surged in the US. The estimated total revenue of the global mobile app market is pegged to reach a staggering $673.80 billion by 2027, which reflects the growing reliance on digital solutions for financial transactions.

For users keen on maximizing their iPhone for mobile banking, the key lies in embracing the latest security measures. With advancements like open banking, simplified analytics, and NFC technology, you have unprecedented control over your finances. However, you wouldn’t want to compromise on security. In this guide, we’ll equip you with the tips to bank fearlessly on your iPhone. By the end of this read, you’ll have leveled up your mobile banking security game!

5 Tips to make mobile banking secure on iPhone

Using your iPhone for mobile banking offers unparalleled ease and efficiency in managing your finances. Here’s how you can use it to your advantage:

1. Choose the right mobile bank

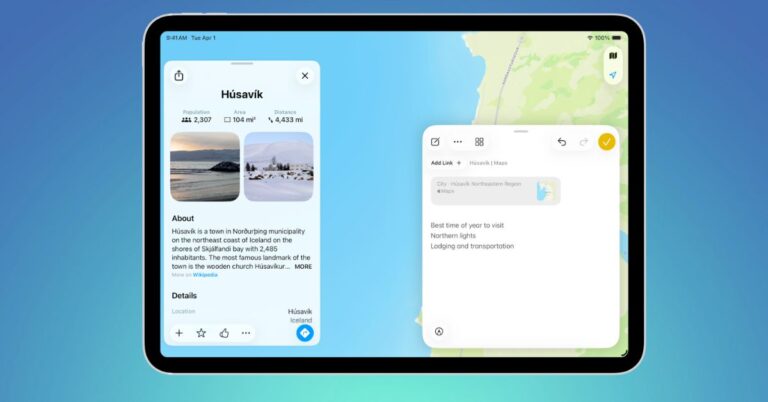

Due to digitalization, most traditional banks are now offering the convenience of mobility. They have now developed iOS apps for banking, allowing clients to access their accounts digitally. Some let their clients open a checking account with no deposit.

Our advice would be to choose a bank that has developed a mobile app highly compatible with iPhones. Some banks seamlessly integrate with Apple Pay and their vast ATM network.

For more security, ensure you’re using your bank’s official app. These apps generally offer enhanced security features and are optimized for mobile use, providing a safer and more user-friendly experience.

2. Maximize iPhone security

There are some basic security measures you need to make mobile banking secure on iPhone:

- Ensure your mobile banking accounts and iPhones come with strong, unique passwords. Avoid using easily guessable information like birthdays or pet names. A robust password should mix words, numbers, and special characters.

- It would also help to stay vigilant against phishing attempts. Be cautious of emails or texts that seem suspicious or ask for personal information. Always verify the legitimacy of such communications before responding.

- According to Apple, scammers may send emails and messages mimicking legitimate companies such as Apple. They may also resort to bogus promotions that will allow them to exploit your personal information.

- Install anti-malware software on your devices and regularly check app permissions on your iPhone to prevent unauthorized data access.

- Also, utilize the iPhone’s remote wiping feature for additional security in case your device is lost or stolen.

3. Be location-conscious

Be mindful of your surroundings when using mobile banking apps in public.

- Avoid exposing sensitive information to onlookers, and try to perform your banking activities in private and secure places.

- Additionally, consider using privacy screen protectors on your iPhone to minimize the visibility of your screen to others nearby.

- When entering sensitive information like passwords or PINs, shield your device screen from prying eyes.

- It’s also advisable to avoid using public Wi-Fi networks for mobile banking, as they may not be secure. It’s best to use mobile data or a trusted and secure Wi-Fi network.

4. Monitor your accounts

One survey highlights that 30 percent of Americans check their bank accounts once a week, at the very least. Mobile banking apps make this easy and accessible, allowing you to monitor your finances regularly.

This proactive approach not only keeps your balances in check but also empowers you to swiftly identify and address any discrepancies or unauthorized transactions. With the user-friendly interfaces of mobile banking apps, you can regularly and securely monitor your finances. It ensures your financial well-being is always in sight.

Part of monitoring should be setting up notifications. Consumers with alerts are less likely to experience fraud. These alerts act as a proactive defense mechanism against unauthorized activities in your accounts.

5. Use mobile wallets

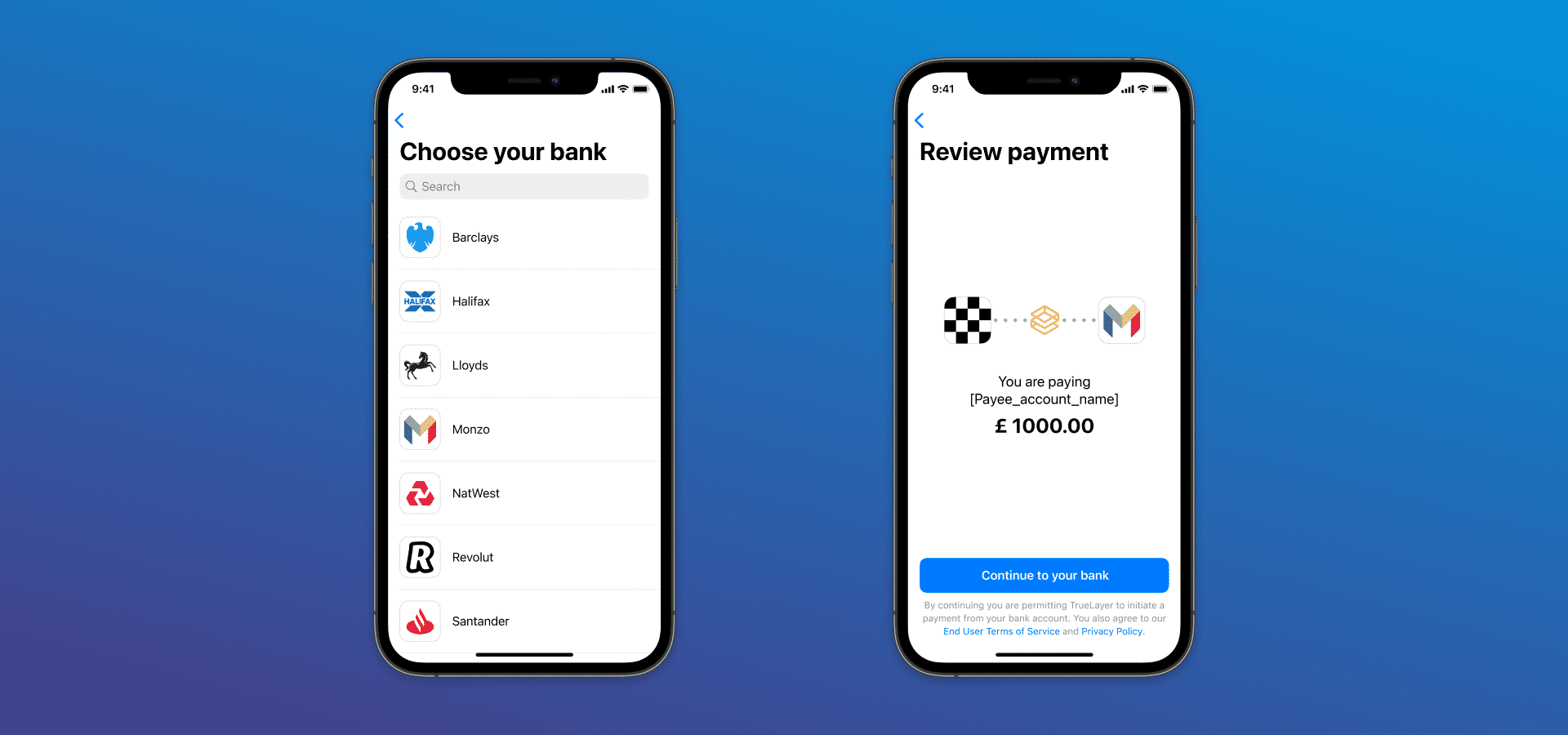

Embracing mobile wallets aligns with a global trend toward cashless transactions.

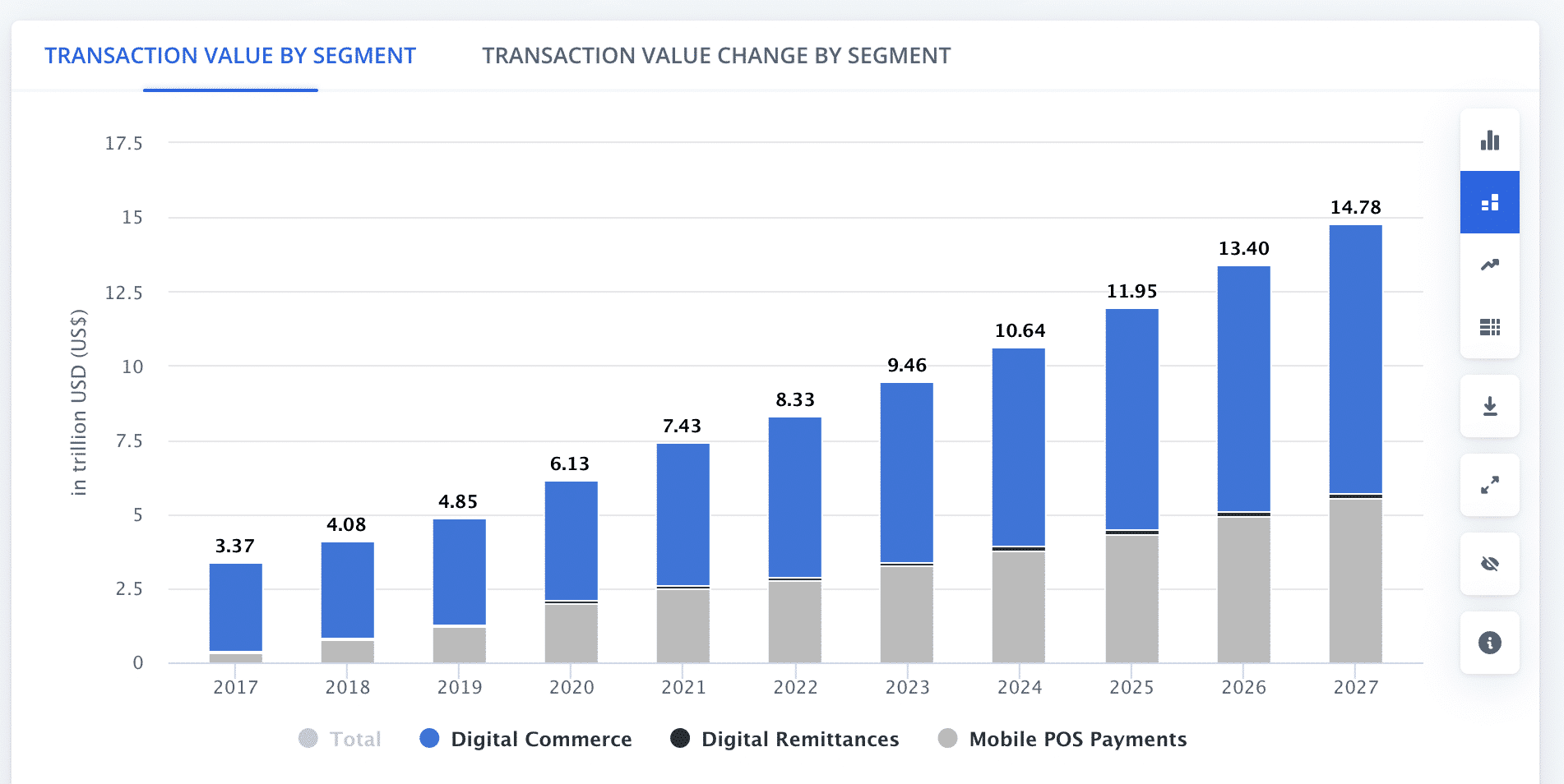

According to Statista, the transaction value of mobile payments is expected to reach $9.46 trillion globally by 2023. This data underscores the remarkable growth and ubiquity of mobile wallets, which have become integral components of numerous mobile banking apps.

Additionally, the convenience of mobile wallets extends beyond transactions. They also offer features like expense tracking and digital receipts, providing users with a holistic financial management experience.

As the world transitions toward a cashless future, integrating mobile wallets into your mobile banking routine is a must. Not only does it simplify payments, but it also aids in financial organization.

With this seamless integration, users can make secure and convenient payments, tapping into the expanding landscape of digital finance.

Experience convenience with Mobile Banking on your iPhone!

Leveraging your iPhone for mobile banking offers convenience and a range of financial services at your fingertips. You can safely and efficiently manage finances in the digital age by choosing the right app and following essential security measures. Remember, while technology simplifies banking, it is equally important to stay informed and cautious to protect your financial information.

Read more: