Everything You Need to Know About Apple Card Family

Apple Card Family lets you share your Apple Card with up to five family members, set spending limits, build credit together, and earn Daily Cash rewards, all managed directly from the Wallet app.

Key Takeaways:

- What is Apple Card Family?: Apple Card Family, launched in 2021, lets you share one credit card account with up to five family members through the Wallet app.

- Core Features: It provides shared credit lines, credit building, spending limits for kids, rewards pooling, and privacy controls, all managed directly in Apple Wallet.

- Eligibility Rules: You need an Apple Card, a US-based Apple ID, and a compatible device, while co-owners must be 18 and participants at least 13.

- Setup Process: You can add co-owners or participants in the Wallet app, send invitations, and complete credit checks before access is granted.

- Pros and Cautions: Apple Card Family supports joint credit growth and rewards sharing, but shared debt responsibility, limited availability, and lack of travel perks remain concerns.

Managing money as a family is complicated, from tracking your spending to creating joint credit or establishing limits for children. Apple makes this simpler with Apple Card Family, a feature that enables you to share an Apple Card with the people you care about without giving up control of how it’s used.

In this guide, we’ll break down everything you need to know about Apple Card Family from how to set it up to how to share it with a co-owner. So, you can decide if it’s the right fit for your family.

Table of Contents

- What is Apple Card Family?

- Key Features of Apple Card Family

- Eligibility Requirements

- How to Set Up Apple Card Family

- Advantages of Apple Card Family

- Drawbacks & Limitations

- Apple Card Family vs Other Shared Credit Options

- Tips for Managing Apple Card Family Effectively

- Manage Your Household Spending Wisely!

What is Apple Card Family?

Apple Card Family launched in 2021 to let users share their Apple Card account with up to five other people in their Family Sharing group.

One person is the account holder, another may be a joint holder with equal responsibility, and the remaining members are users who can spend but are not responsible for making payments. It’s all controlled from the Wallet app on your iPhone or iPad, making one credit card a household resource.

So, what’s the Apple Card Family’s unique feature from the standard Apple Card?

- With an individual Apple Card, it’s just your spending, your bills, and your rewards.

- With Apple Card Family, you can share the credit line, set spending limits for others, and even build credit together if you’re a co-owner. Everyone earns their own Daily Cash back on purchases.

Compared to typical authorized user setups on other cards, it emphasizes equal credit building and family controls. It works seamlessly with the Wallet app on iPhone, iPad, Apple Watch, with real-time updates and notifications.

Key Features of Apple Card Family

Apple Card Family packs in tools to make shared credit safe and rewarding. Here’s a breakdown:

- Shared Credit Line: The account owner and co-owner share one credit line. Other participants in the Family Sharing group can use it. You can even merge existing Apple Cards and request to increase credit limit.

- Co-owner Transparency: You can also share the responsibility of making payments and check details of each other’s spending from a single monthly bill.

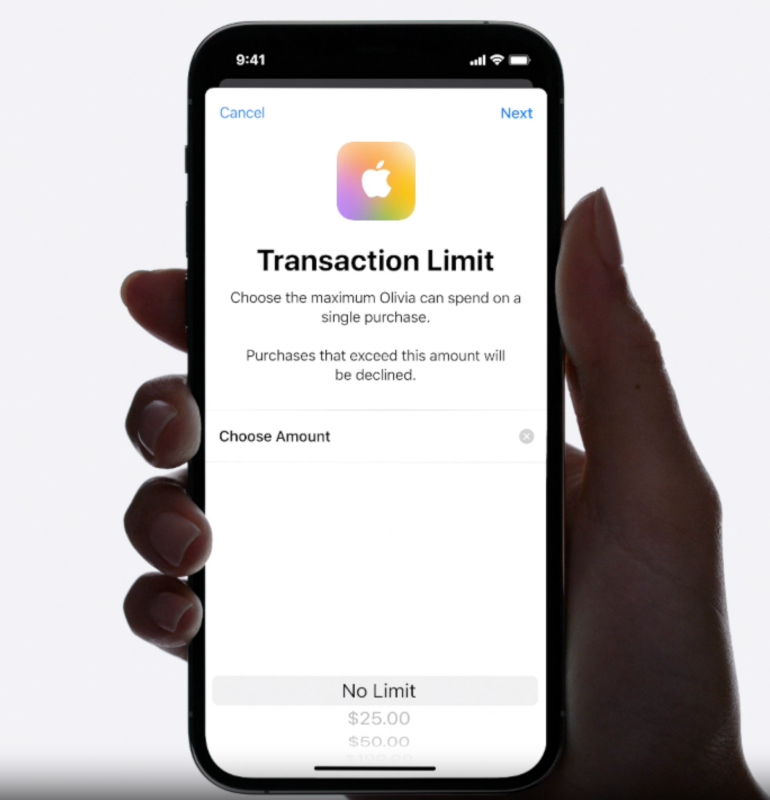

- Parental Controls & Spending Limits: Add anyone who is 13 years or older as a participant to allow them independent spending. You get their transaction insights, set optional transaction limits, lock their ability to spend, and receive notifications about their purchases.

- Credit Reporting for Participants Over 18: Co-owners always build credit equally, with all activity reported to credit bureaus in their names. Adult participants can opt in to be reported as authorized users, helping them build credit history even if they’re not responsible for payments.

- Daily Cash Rewards Shared: Everyone earns unlimited Daily Cash back on their own purchases up to 3% at Apple and select partners, 2% with Apple Pay, and 1% elsewhere. It goes directly to each person’s Apple Cash account, so rewards stay personal.

- Privacy and Security Features: Each person can see only their own transactions in the Wallet app, ensuring privacy. It uses Apple’s top-notch security, like device-based authentication and no card numbers on the physical titanium card. Plus, all family members get their own card (digital immediately, physical for 18+)

These are the reasons why it is a favorite among families, with emphasis on control, rewards, and credit building.

Eligibility Requirements

You must satisfy some minimal requirements to become a part of Apple Card Family:

- The owner of the account must already have an Apple Card and be part of a Family Sharing group with other members you wish to share your card with.

- You need an iPhone or iPad with the latest iOS or iPadOS or a compatible Apple Watch with the latest watchOS.

- Everyone must have an Apple ID with region set to the US, as Apple Card is only available there.

- Participants must be at least 13 years old. Co-owners must be 18 or older, and participants wanting to build credit must also be 18+.

If you’re adding a co-owner, both of you have to agree to merge your separate cards or qualify credit-wise as a new user.

How to Set Up Apple Card Family

Setting up is easy and done directly in the Wallet app. Here’s how:

To Add a Co-Owner

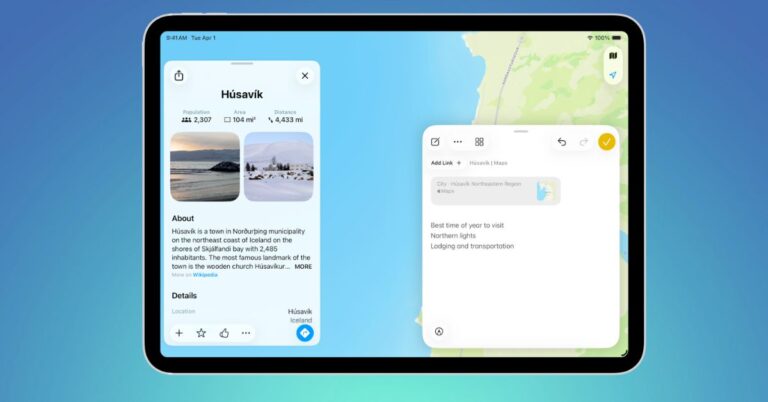

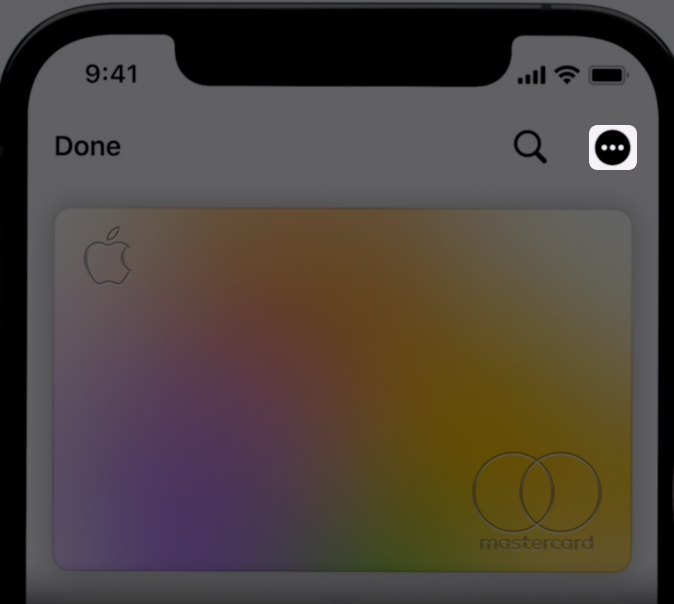

- On your iPhone, launch Wallet and tap your Apple Card. Tap the More button (three dots), then select Account Details.

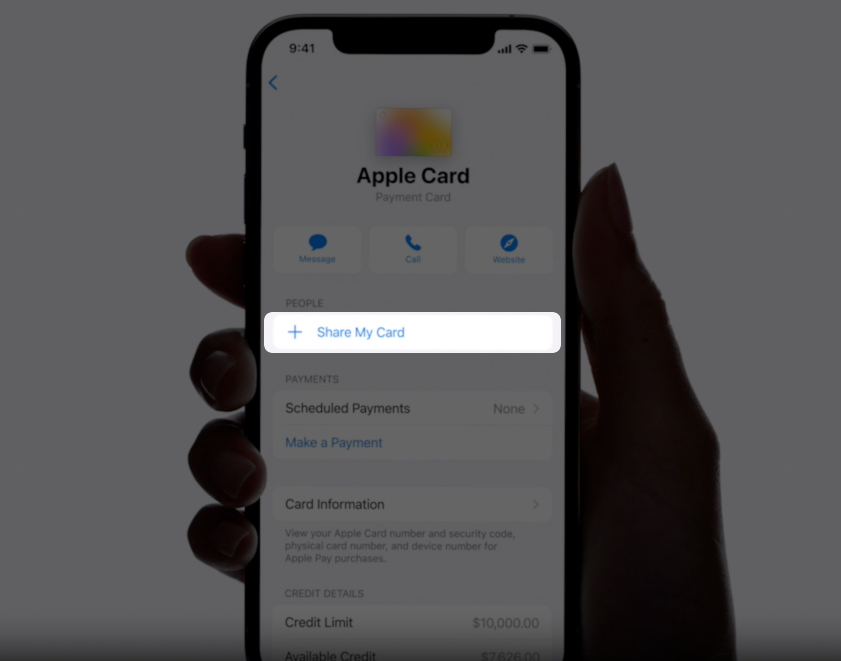

For iPad, go to Settings > Wallet & Apple Pay > Apple Card > Info tab. - Scroll to Apple Card Family and tap Add User. (On older iOS versions, tap Share My Card under the People section)

- Then select Continue to proceed.

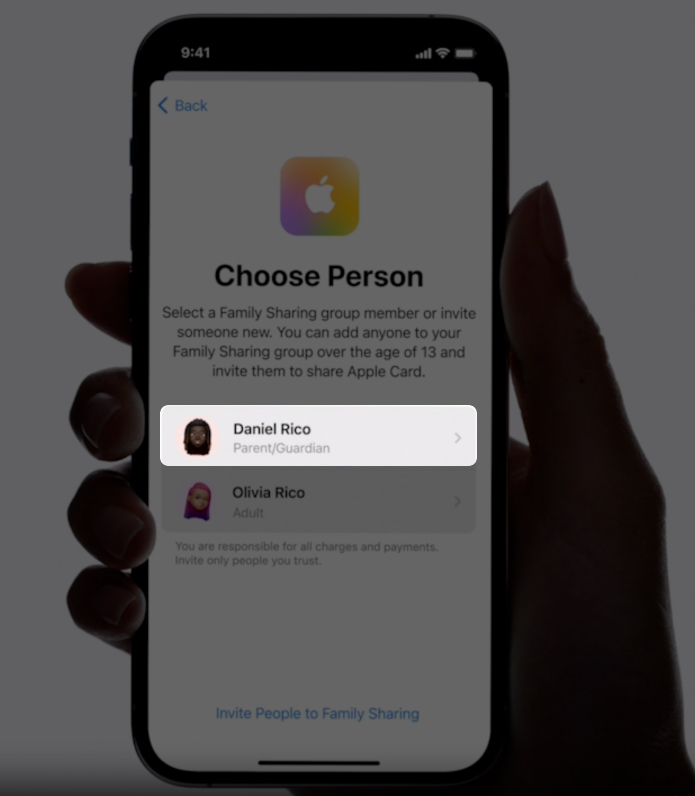

- Pick a participant from your Family Sharing group. If they’re not in it, tap Invite Someone to add them first. Note: only one co-owner allowed.

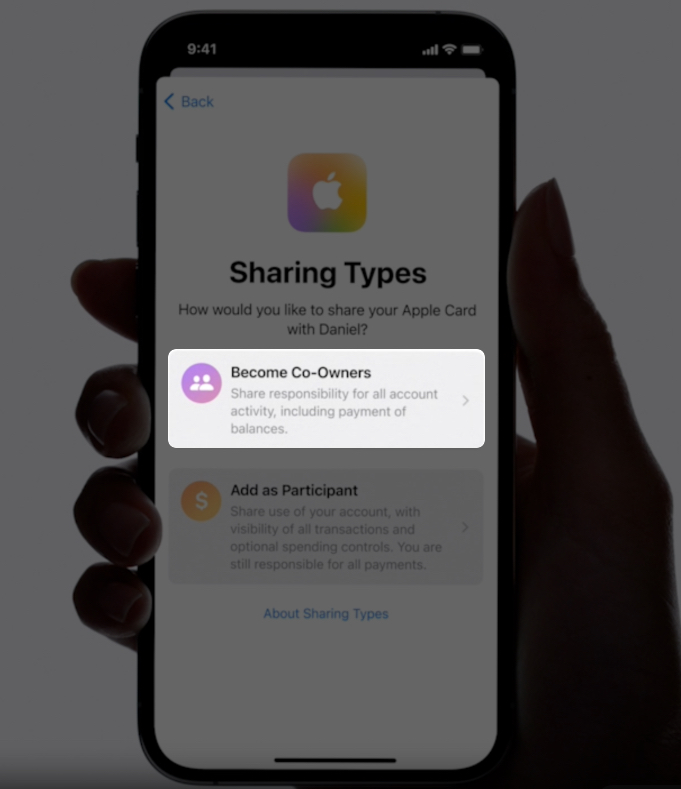

- Tap Become Co-Owners.

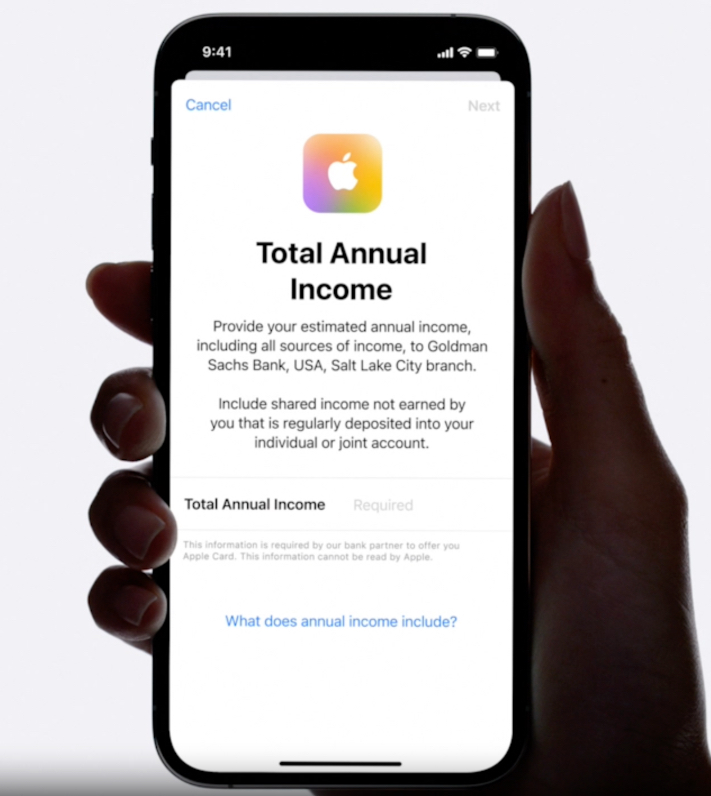

- Follow the prompts to enter details like their total annual income or Social Security number for credit checks.

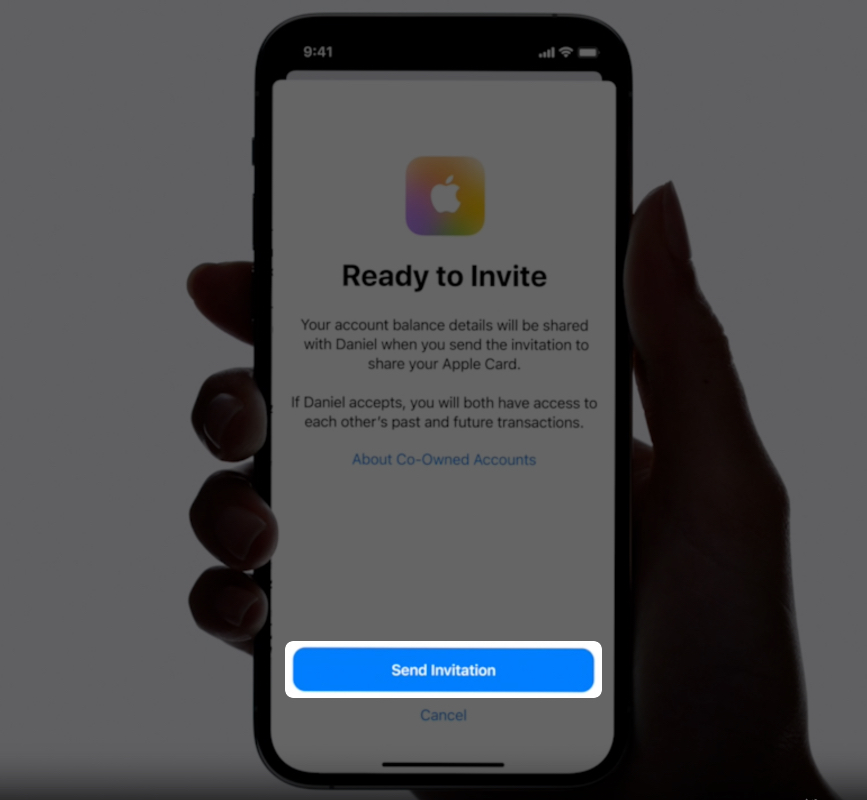

- Tap Send Invitation and authenticate with your passcode or Face ID.

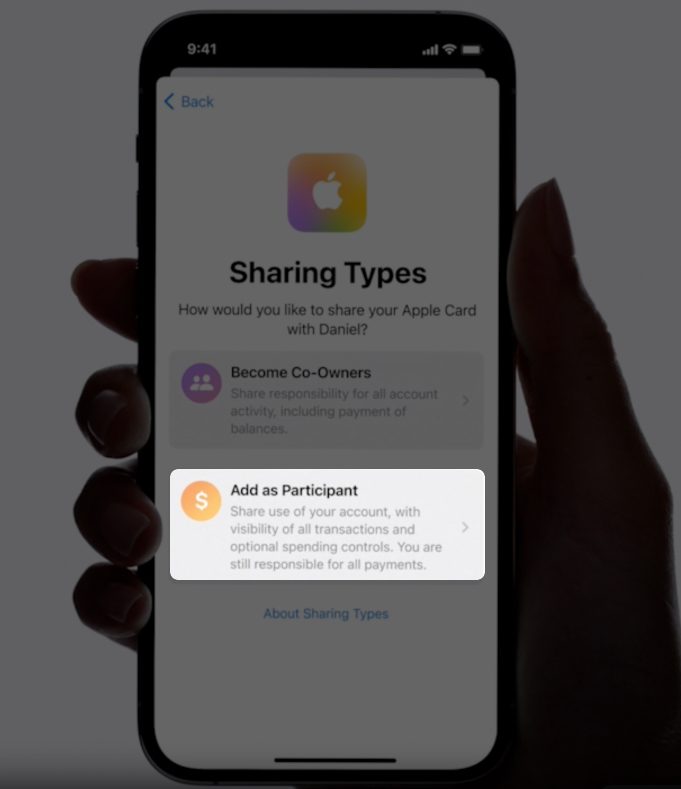

Add a Participant

- From the Wallet app, go to your Apple Card, tap More button, and select Account Details.

- Now, tap Share My Card > Continue.

- Select a family member and tap Add as Participant.

- Enter an amount to set a credit limit for them.

- Tap Next at the top right corner to proceed.

- Finally, tap Send Invitation.

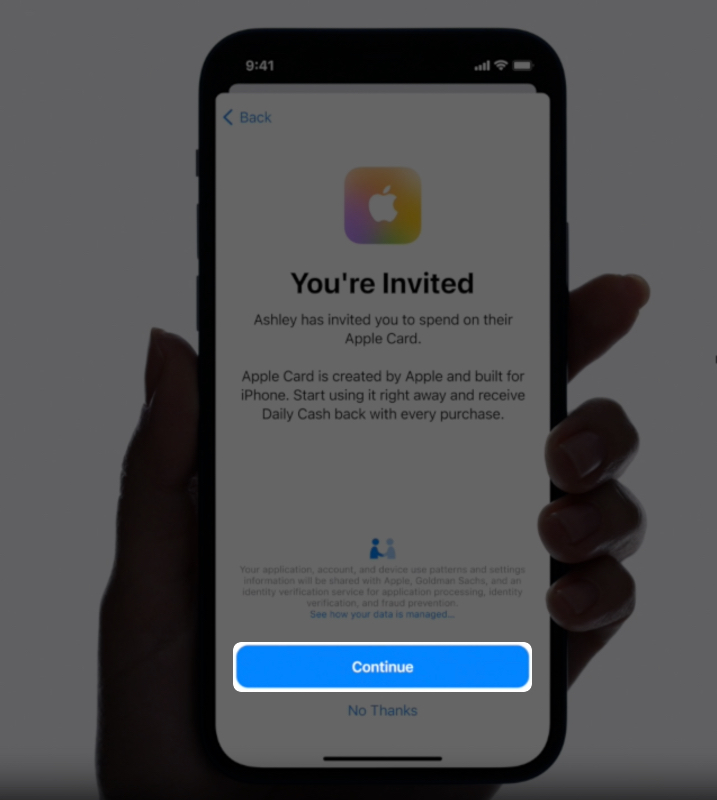

Accepting an Apple Card Family Invite

- Once the owner successfully sets up Apple Card Family, you’ll get a notification. Tap it, or open Wallet and tap the badge in the corner.

- Tap Continue, then select Accept Apple Card (for participants).

If you’re a co-owner, enter your details and complete the application. Once Apple approves your card, tap Accept Shared Card. The owner also needs to accept the shared card to start spending. - Adult participants can choose to build credit during acceptance or later in Account Details > Build Credit History.

After you share your Apple Card with family, all can begin using the card digitally immediately. Physical titanium cards are mailed to 18+; owners can request them for participants under 18.

Advantages of Apple Card Family

Apple Card Family is more than just sharing a credit card: it’s about making money management simpler and smarter for everyone in your home. Here are some of the biggest perks:

- For couples, co-owners can merge credit lines and build credit together, sharing responsibility without separate bills. Families can set limits for teens to learn budgeting while earning Daily Cash on their buys.

- Everyone builds better habits: positive payments boost credit scores for co-owners and opting-in participants.

- Rewards add up fast, with no annual fees, and privacy keeps things fair.

It’s all in one app, with real-time tracking, making it easier than juggling multiple cards. Plus, it’s a great way to teach financial literacy to kids starting at 13.

Drawbacks & Limitations

While handy, Apple Card Family isn’t perfect. Here are a few things to keep in mind before you jump in:

- The biggest issue is shared responsibility. Late payments or high balances hurt everyone’s credit, especially co-owners who are equally liable. Participants’ credit can suffer too if they opt in.

- It’s limited to the US and requires Apple devices, so Android users or international families are out.

- Daily Cash goes to each person’s Apple Cash account if set up, which might not suit families wanting pooled rewards.

- Adding a co-owner means a credit check, and you can’t easily switch back without closing the account.

- There’s no sign-up bonus like some cards, and if the Goldman Sachs partnership ends (rumored by 2030), changes could come.

- You won’t find extras like airline miles or travel points that some traditional credit cards offer.

- Also, under-18s can’t build credit, and maxing out limits affects scores.

So, while Apple Card Family is great for Apple users who want simple money sharing, it might not be the best fit if you’re after more advanced rewards or if not everyone in your family uses Apple devices.

Apple Card Family vs Other Shared Credit Options

Apple Card Family isn’t the only way to share a credit account. Banks have been offering joint credit cards and authorized user options for years. But Apple puts its own spin on things. Let’s break it down:

- Vs. Traditional Authorized Users (e.g., Chase Sapphire Preferred or Amex Gold): These let you add users, but only the primary cardholder builds credit, authorized users often don’t, or it’s limited. Apple allows opting in for participants 18+, and co-owners build equally. Controls are basic on others; Apple’s app makes limits and notifications easier.

- Vs. Joint Accounts (e.g., Capital One Duo or Discover Cards): Joint accounts share responsibility like Apple’s co-owner, but they’re rarer and don’t offer family-style participants or kid controls. Apple integrates with your phone for better finance tracking.

- Vs. Other Family Cards (e.g., Amazon Prime Rewards Visa): These might share rewards but lack Apple’s privacy, credit equality, or seamless setup. Apple wins on no fees and Daily Cash, but others could have better travel perks.

Overall, if you’re in the Apple world and want credit building for all, it’s top-notch. You don’t need to pay any annual fees, late fees, or foreign transaction fees. However, for broader rewards, look elsewhere.

Tips for Managing Apple Card Family Effectively

Sharing a credit card with family or friends can be super convenient but it also needs a little teamwork to keep things running smoothly. Here are some simple tips to make the most of Apple Card Family:

- Set Clear Limits Early: Use the Wallet app to set limits for kids or younger users. It keeps surprises off your bill and helps them learn good habits.

- Talk about Money Openly: Chat with others about budgets and spending to prevent misunderstandings later.

- Monitor Spending: Keep an eye on transactions, Daily Cash rewards, and spending summaries. The Wallet app shows all in real time.

- Opt In for Credit Wisely: For 18+ participants, enable credit reporting if the account is in good shape and not overly utilized.

- Handle Rewards Smartly: Since Daily Cash is personal, teach users to save or transfer it via Apple Cash.

- Pay on Time, Every Time: Since co-owners share credit responsibility, make sure payments are never late. It helps protect everyone’s credit score.

- Review Who’s on the Account: Every once in a while, check if everyone still needs access. If not, you can easily remove the participants.

These keep things smooth and educational.

Manage Your Household Spending Wisely!

Apple Card Family makes it easier to share a credit card, manage spending, and even build credit together, all within the Apple ecosystem you already use. It’s great for families or couples who want transparency, control, and rewards without the hassle of extra fees.

So, if you have an Apple Card, try sharing it with your family members and see how it streamlines your household spending! Along with these, try other Family Sharing features such as sharing apps and subscription purchases to save money.

FAQs

Yes, account owners or co-owners can remove participants via the Wallet app: Go to Account Details, select the person, and tap Stop Sharing. Participants can self-remove too. For co-owners, you must close the entire account. After removal, they can’t spend, but you’re still responsible for any balance.

Yes, it can. Positive habits like on-time payments boost scores for co-owners and opting in participants. But negatives, like late payments or high utilization, hurt everyone involved.

Yes, as participants starting at age 13. They can spend within limits and earn Daily Cash, but they can’t build credit history until 18.

You can add up to five people: one co-owner and four participants, for a total of six including the owner.

Yes, there’s no extra fee for Apple Card Family. It’s part of the no-annual-fee Apple Card. You just pay interest on balances like any credit card.

Related articles worth reading: